Business Incentives

Local Incentives

Opportunity Zone

Portions of the northwest side of Lincoln have been designated as an opportunity zone, an area where new investments may be eligible for preferential tax treatment under certain conditions. Opportunity zones encourage economic development in low-income communities by attracting private investment, creating jobs, and economic growth. Investors can postpone paying taxes on previous gains by investing in a Qualified Opportunity Fund (QOF) until December 31, 2026, or until the QOF investment is sold or exchanged, whichever comes first. The investment duration in the QOF determines the tax benefit for the investor.

Further information: DCEO (illinois.gov)

Map: Opportunity Zone Map - City of Lincoln, Illinois (arcgis.com)

Enterprise Zone

The Illinois Enterprise Zone Program aims to boost economic growth and revitalize neighborhoods by offering state and local tax incentives, regulatory relief, and improved governmental services. Some of the benefits include reduced building permit fees, property tax abatements, jobs tax credits, dividend income deductions, interest deductions, contribution deductions, sales tax exemption for building materials, sales tax deduction for machinery and equipment/pollution control facilities, utility tax exemption, and investment tax credit. The Logan County Enterprise Zone Manager administers the Lincoln/Logan County Enterprise Zone. Learn more about the Lincoln/Logan County Enterprise Zone here.

Further Information: Illinois Enterprise Zone Program - Tax Assistance

Map: Enterprise Zone Map - Logan County, Illinois (arcgis.com)

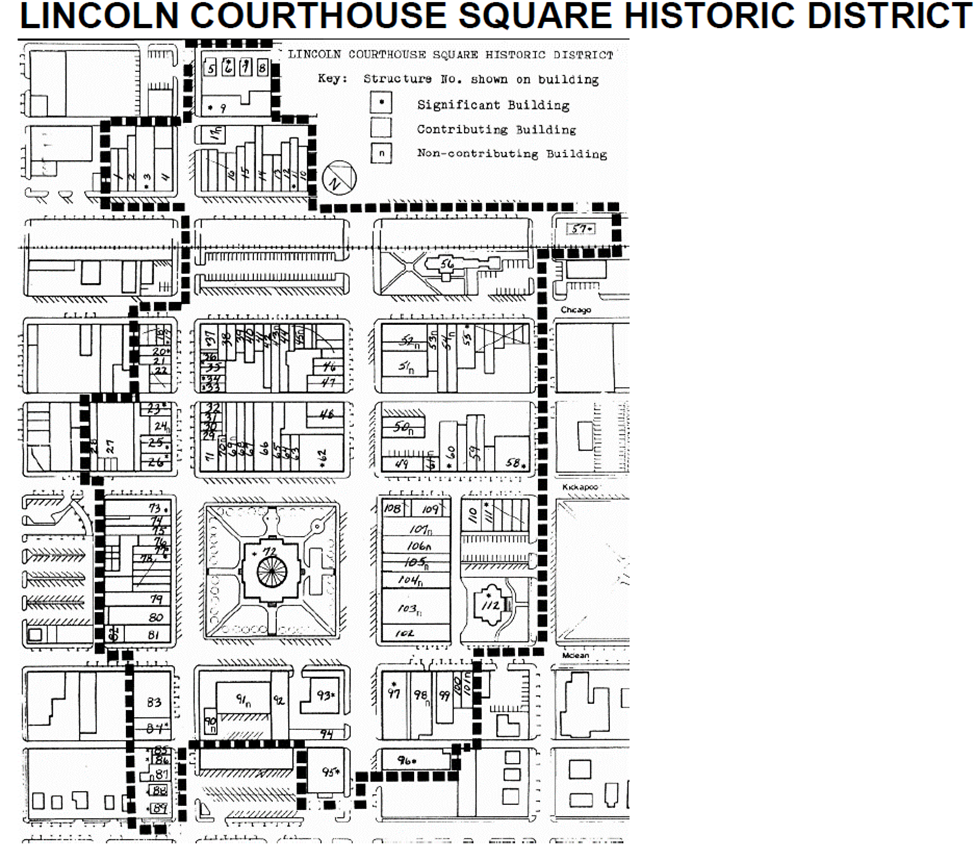

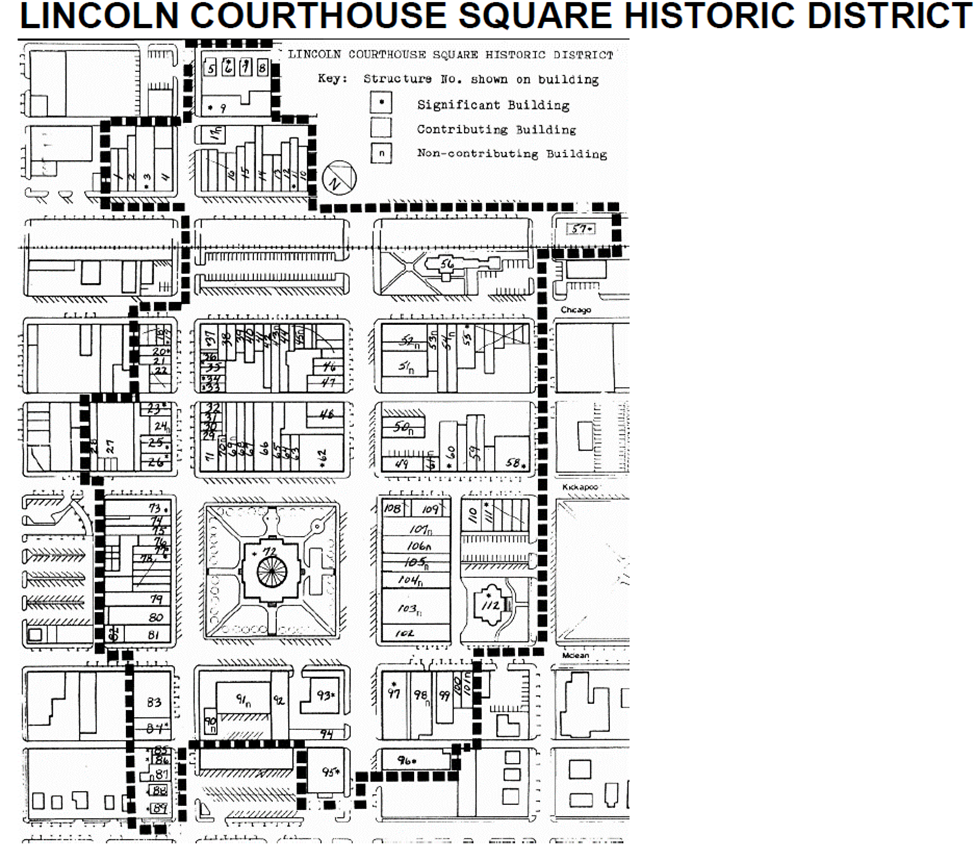

Lincoln Courthouse Square Historic District

Since 1985, a 10-block area around the Logan County Courthouse has been designated a historic district on the National Register. This designation permits eligible projects within the district to seek federal and state historic tax credits. As per existing legislation, these tax credit programs have been proven to generate employment, boost local economies, and breathe new life into historic buildings and communities.

Further Information: https://dnrhistoric.illinois.gov/preserve/statecredit.html

Tax Increment Financing District (TIF)

Lincoln's Tax Increment Finance District is situated in Central Downtown. Projects within the district result in higher property tax revenues, which are then used to cover the expenses related to developing or redeveloping properties within the district. The district's purpose is to promote new economic development and job creation that might not have happened otherwise. Specific TIF guidelines for Lincoln can be accessed through the "more information" link below.

More Information: Tax Increment Financing (TIF) (lincolnil.gov)

Map: TIF District Map - City of Lincoln, Illinois (arcgis.com)

State Incentives with Enhanced Credits in Lincoln

In Lincoln, projects located in underserved areas can receive enhanced credits under several state programs. These include benefits under the Economic Development for a Growing Economy Tax Credit Program, Data Center Investment Tax Exemptions and Credits, and the Illinois Apprenticeship Education Expense Tax Credit Program. A map of the designated area is available here.

Map: Incentives (illinois.gov)

Economic Development for a Growing Economy (EDGE) Tax Credit Program

Businesses that meet specific job creation and project investment requirements may qualify for annual corporate tax credits through Illinois’ EDGE Tax Credit Program. Eligible companies that contribute to job creation, capital investment, and overall improvement of living standards for all Illinois residents can apply for tax credits equal to 50% of the income tax withholdings of new jobs created in the state. This percentage increases to 75% if the business expansion project is in an "underserved area" census tract.

More information: Economic Development for a Growing Economy Tax Credit Program (EDGE) - Incentives (illinois.gov)

Data Center Investment Tax Exemptions and Credits

Under the Data Center Investment Tax Exemptions and Credits programs, qualifying Illinois data center owners and operators are exempt from specific state and local taxes. Based on their capital investment, new and existing data centers may also be eligible for a tax credit of 20% of wages paid to construction workers for projects in underserved markets, such as those identified within Lincoln.

More information: Data Center Investment Tax Exemptions and Credits - Incentives (illinois.gov)

Lincoln Courthouse Square Historic District

Since 1985, a 10-block area around the Logan County Courthouse has been designated a historic district on the National Register. This designation permits eligible projects within the district to seek federal and state historic tax credits. As per existing legislation, these tax credit programs have been proven to generate employment, boost local economies, and breathe new life into historic buildings and communities.

Further Information: https://dnrhistoric.illinois.gov/preserve/statecredit.html

Illinois Apprenticeship Education Expense Tax Credit Program

Under this program, employers can receive a tax credit for educational expenses related to qualified apprentices. Employers who employ qualified apprentices may be eligible for a credit of up to $3,500 per apprentice. Employers or apprentices who live or conduct business in the underserved areas of Lincoln can receive an additional credit of $1,500 per apprentice. The Department limits the total tax credits to $5 million per calendar year, so submitting complete applications early in the process is essential.

More information: Illinois Works Apprenticeship Initiative - Illinois Works

Additional Illinois Resources

Businesses in Lincoln, Illinois, may be eligible for extra incentives and tax credits available throughout the state. This includes a range of support, such as grants, early-stage investment, and other programs offered by the Illinois Department of Commerce and Economic Opportunity. Learn more about the potential expansion and relocation assistance programs in Illinois.

Have Questions?

LEAD CEO Andrea Runge and the Board can make it easy for you.

Schedule a call with Andrea today and she’ll help you get the best incentives for your business in Lincoln, the hub of central Illinois.